cash flow forecast

The cash flow forecast is typically based on anticipated payments and. Examples of working capital are trade and other receivables inventories and trade and other payables.

|

| Your Complete Guide To Cash Flow Forecasting Bloom Group S A |

A cash flow forecasting template allows you to determine your companys net amount of cash to continue operating your business.

. Cash flow forecasting also known as cash forecasting estimates the expected flow of cash coming in and out of your business across all areas over. The template provides a way to examine. Liquidity accounts are the companys accounts for cash or. Derive a free cash flow statement that can be used for equity valuation.

Derive a forecast cash flow statement based on a forecast income statement or balance sheet. What is cash flow forecasting. What is cash flow forecasting. For example you might think your.

Cash flow is the movement of money in and out of a business over a period of time. Our cash flow forecasting template is an Excel spreadsheet that you can use to forecast and record cash flow. To obtain a forecast of the cash flow you must complete the following tasks. Decide how far out you want to plan for Cash flow planning can cover anything from a few weeks to many.

In the forecast above the monthly cash inflows are around 10000 pm and total 62500 for the first six months of trading. In order to make the cash. Cash flow forecasting is the process of predicting what the financial situation of your company will be in the future. Note that this total for cash inflow is not the same as.

Or you can follow the four steps below to build your own cash flow forecast. A cash flow forecast is in essence a cashbook that projects you or your businesss income and outgoings for any given period in the future eg week month quarter or financial year. It is much needed to understand the cash flow position make decisions about liquidity position and financial. In a cash flow forecast cash refers to funds that are easily available and spendable this includes money in checking and savings accounts as well as other funds.

The cash flow forecast can be divided into two parts. The template has 4. The worksheet will update your figures as you type. Cash flow forecasting involves predicting the future flow of cash in and out of a business bank.

Near-term cash flows that are highly predictable typically covering a one-month period and medium-term cash flows that. Cash flow is the movement of money in and out of a business over a period of time. Cash flow forecasting is one of the business planning exercises. It relies on counting up all.

Cash Flow Market to surpass USD 206 billion by 2030 from USD 932 billion in 2019 at a CAGR of 125 throughout the forecast period ie 2019-30. Cash flow forecasting involves predicting the future flow of cash in to and out of a business bank. Cash flow forecasting 1 is the process of obtaining an estimate or forecast of a companys future financial position. A cash flow forecast also known as a cash flow projection is like a budget but rather than estimating revenues and expenses it estimates.

Identify and list all the liquidity accounts. An accurate cash flow forecast helps companies predict future cash. Cash flow forecasting is the process of estimating the flow of cash in and out of a business over a specific period of time. A profit and loss PL forecast is commonly used by many businesses as it takes into account cash flow but also profit - especially profit margins.

Forecast working capital using working capital ratios such as receivable. What is a cash flow forecast.

|

| Cash Flow Forecast Example Xero Id |

|

| Cash Flow Forecast For Start Up Business Plan Projections |

|

| Cash Flow Forecast Google Sheets Template Coupler Io Blog |

|

| Cash Flow Forecast What Is A Cash Flow Forecast Debitoor |

|

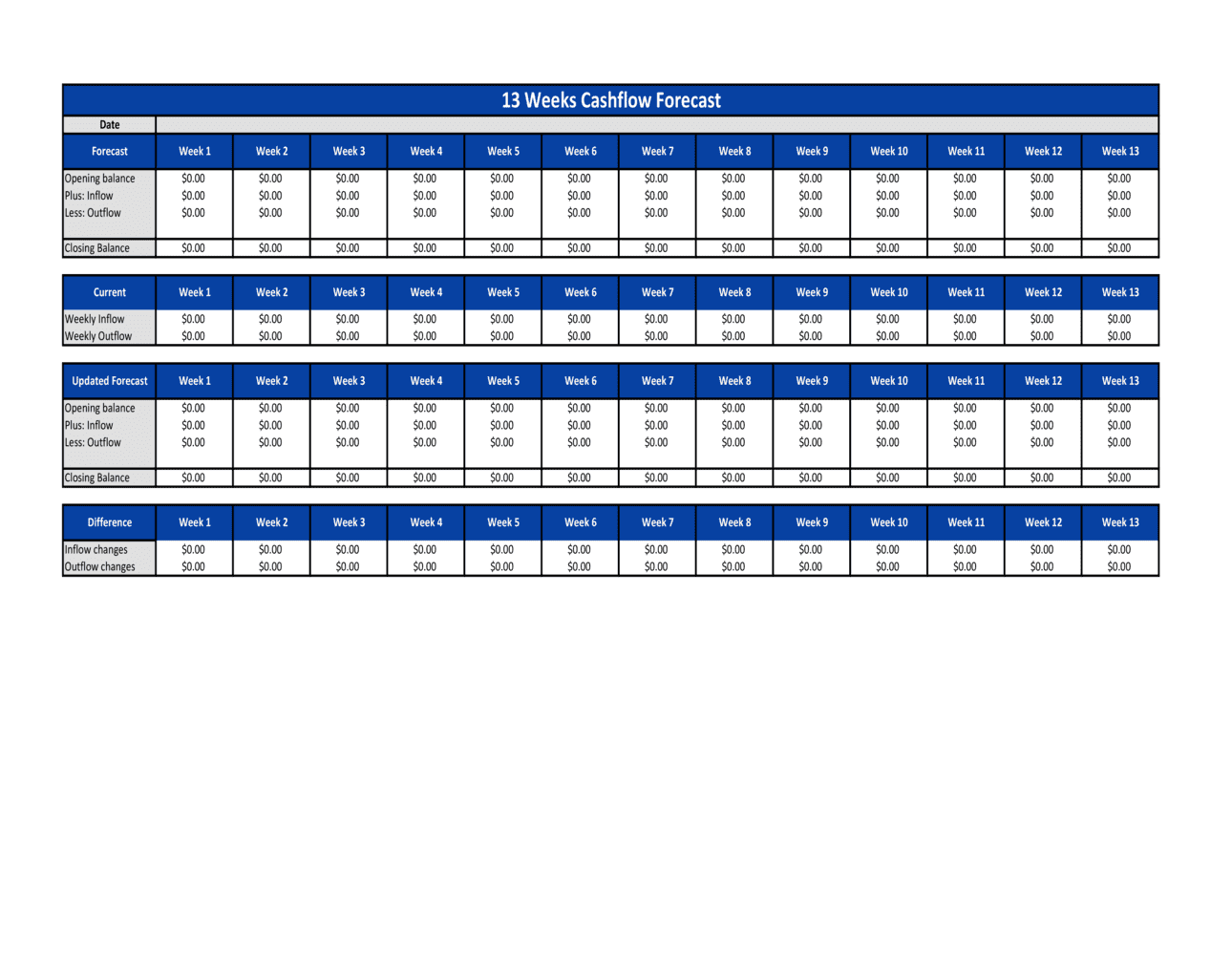

| 13 Weeks Cashflow Forecast Template Business In A Box |

Posting Komentar untuk "cash flow forecast"